Inaccurate Credit Reports Due to Your Mortgage Company?

We Can Help.

- Inaccurate Credit Reporting

- Credit Reporting Errors

- Inaccurate Payment History

- Unable to Qualify for Loan

- Refuse to Accept/Report Payments

- Denied Credit

- Unable to Refinance

- ‘Lost’ Mortgage Payments

- Failed to Update After Bankruptcy

- Harassing Phone Calls

Nationstar – Mr. Cooper

Within a couple of months in 2018, the states of California, Massachusetts, and New York levied heavy fines against Nationstar, now doing business as Mr. Cooper, for illegal practices. In California the Company agreed to a $9.2 million fine for allegedly overcharging borrowers and for failing to resolve their complaints. In Massachusetts, the company was hit with a fine for allegedly offering borrowers “unfair and deceptive” loan modifications. In April 2019, they settled with the New York State Department of Financial Services, agreeing to pay a $17 million fine.

In 2017, Nationstar changed its name to Mr. Cooper to try and rebuild trust with its customers. However, Nationstar, now doing business as Mr. Cooper, has been accused of continuing to violate the Fair Credit Reporting Act—or FCRA—which is a federal law that regulates a consumer’s credit information and the way the companies like Nationstar or Mr. Cooper are allowed to report and use that information.

Ocwen Financial

Many states, including Florida, California, Illinois and Texas filed suit against Ocwen Financial over servicing violations in 2017. In early 2018, Ocwen Financial was blocked by dozens of states from handling any additional mortgages in their states. However, each state later lifted the restriction based on a promise by Ocwen to do a better job servicing loans. Unfortunately, the mortgage company’s servicing problems did not end there. As recently as 2019, Ocwen Financial agreed to pay $2 million in restitution to mortgage borrowers in Massachusetts for alleged “widespread” mortgage servicing problems.

In 2019, Ocwen Financial announced they would be rebranding their reverse lending and loan servicing divisions as PHH Mortgage and Liberty Home Equity Solutions.

RECENT RESULTS*

Dan’s Story

Mr. Cooper, formally known as Nationstar, agreed to a settlement with our client for his second mortgage. As part of the agreement, Nationstar agreed to report to the credit reporting agencies that the second mortgage was “settled.” This was never done, and we sued Nationstar, got the client’s credit report corrected and settled his case without our client having to go to court.

Al’s Story

Mr. Cooper double charged our client, and also reported the false late payments to the Credit Bureaus. We sued Nationstar, got our client’s credit reporting inaccuracies corrected and settled his case.

Chris and Duane’s Story

Our clients tried to refinance their home when they realized that their mortgage with Mr. Cooper was not reporting a payment history to the credit reporting agencies. It was as if the mortgage didn’t exist. As a result, our clients were unable to refinance. We helped the clients send 3 rounds of dispute letters to correct the issues, but nothing was done. We sued Mr. Cooper in federal court and were able to get our client’s credit reports to accurately report their mortgage and negotiated a settlement for them.

Liz’s Story

Client’s mortgage was not included in her Bankruptcy, but Mr. Cooper reported the mortgage as included in her bankruptcy with an inaccurate pay history. We sued Mr. Cooper and we were able to get her credit report updated to accurately reflect the payment history and settled her case against Mr. Cooper.

HOW CAN WE HELP YOU TODAY?

Please contact us today for a Free, confidential, no-obligation case review.

CALL US TODAY FOR FREE ADVICE.

1-888-578-4755

YOU PAY NOTHING UNLESS WE WIN YOUR CASE.

NO MATTER WHERE YOU LIVE, HELP IS ONLY A PHONE CALL AWAY.

WE HANDLE CASES IN ALL 50 STATES.

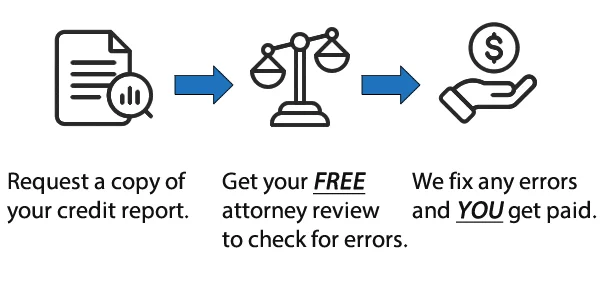

Do you have a Credit Reporting Error?

Many people do not even realize they have an issue with their credit reports because they either have not looked at them or do not know how to access them. It is very simple and easy to access your credit reports.

Mortgage companies such as Nationstar, Mr. Cooper, and Ocwen have been accused of continuing to violate the Fair Credit Reporting Act – or FCRA – which is a federal law that regulates a consumer’s credit information and the way mortgage and loan servicing companies are allowed to report and use that information.

To learn more, call us today at:

1-888-578-4755

YOU PAY NOTHING

UNLESS WE WIN YOUR CASE

Steve Fields

Founder, Fields Law Firm

If your mortgage or loan servicing company caused an error on your credit report you probably do not know where to turn for help in getting it corrected and that you can get paid for their mistake.

Hiring a lawyer might seem too costly, and you may be hesitant to contact an attorney for help. At Fields Law Firm we have our Win-Win Guarantee® which can help put your mind at ease.

It’s a simple promise that means there are no upfront costs for having an attorney—we only get paid if you get paid. We believe everyone deserves the right to have an attorney on their side without the worry of expensive legal bills.

With our Win-Win Guarantee® we will fight to get your credit report corrected and get you money. All at no risk to you. There is No Fee unless we win.

You get the benefit of being able to choose the best attorney for your case with no risk. It’s a win-win solution for you.